Do you qualify for First-Time Home Buyer Incentives?

Ready to purchase your first home but not sure how to get the most for your hard-earned money?

Dolce Vita Homes can help! This September, the Federal Government will be rolling out the First-Time Home Buyer Incentive program, which could save you up to $200 on your monthly payments without having to increase your down payment.

Dolce Vita can help you:

- Determine if you qualify for the program

- Select a home that fits your lifestyle

- Submit your application

- Take possession after November 1

Contact us today to get first choice on great new Dolce Vita homes, duplexes and townhomes.

What is the NEW First-Time Home Buyer Incentive?

Administered by the Canadian Mortgage and Housing Corporation (CMHC), this program will offer a shared equity mortgage with the government for those who qualify.

This simply means that the Government will provide you with 10% of the purchase price for a new home to help reduce your monthly mortgage payments.

What are the Benefits?

- Reduces your monthly payments by reducing the amount you need to borrow

- Interest-Free – you are not required to pay interest on the loan (unlike a line of credit or other standard loans)

- No ongoing repayments – you are only required to repay the loan when you sell your home (or after 25 years, whichever comes first),

- No pre-payment penalty if you choose to repay the incentive at any time

Who is Considered a First-Time Home Buyer?

A “first-time home buyer” doesn’t strictly refer to those who have never owned a home before. You can also qualify if you have not lived in a home that you own for the past 4 years OR if there’s been a recent change to your marriage or common-law status.

Other program criteria include:

- At least one borrower must be a first-time home buyer

- Total qualifying income cannot exceed $120,000 per year

- Total borrowing amount (mortgage plus incentive amount) is less than 4 times the qualifying income

- Must have a minimum down payment of 5% of the purchase price from:

- your own savings,

- an RRSP, or

- non-repayable financial gift from a relative

How Does It Work?

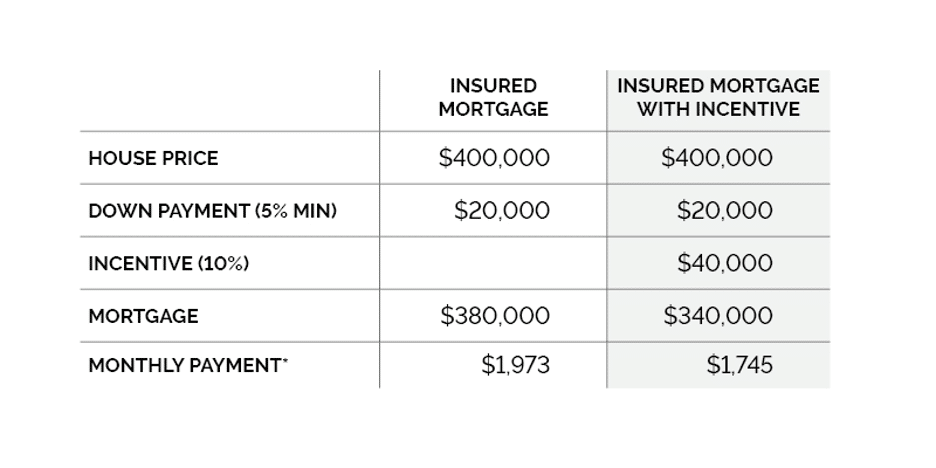

As an example, let’s say you have saved enough for a down payment on a $400,000 newly built home. By using the new First-Time Home Buyer Incentive program, you would pay the $20,000 down payment (required 5% minimum) and receive $40,000 from CMHC (10% of the cost of a new home). The incentive would drop your total mortgage amount and your monthly payments would decrease by over $200 a month. That’s over $2,400 a year in reduced payments and savings!

* Please note, this is a basic calculation for illustrational purposes and does not include property taxes, insurance fee, etc.

How is the Loan Repaid?

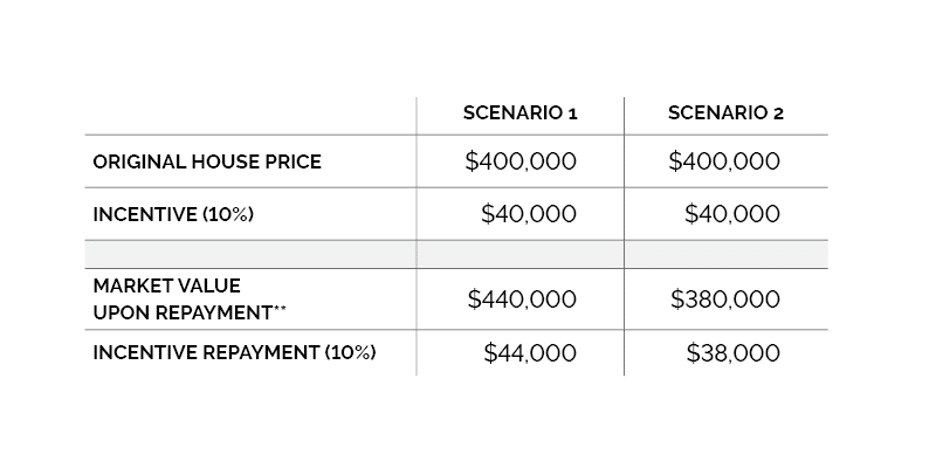

The Federal Government shares the potential changes in property values with you over the time you own your home.

When you are ready to sell your home (or after 25 years, whichever is earliest), you would need to repay the incentive at 10% of the fair market value at that time.

** Please note, these examples are for illustrative purposes only and are not an indicator of how property values are forecasted.

How Can I Get Started?

Contact Dolce Vita Homes today by filling out the form below or visiting one of our show homes to get first choice on great new homes, duplexes and townhomes.

We can help you:

- Determine if you qualify for the program

- Select a home that fits your lifestyle or find a life-ready home

- Submit your application

- Take possession after November 1

What are you waiting for? Reach out today to get the new home you’ve been dreaming of!