Discover the Benefits of Canada’s New First-Time Home Buyer GST Rebate Program

Empowering Canadians to Achieve Homeownership

The Government of Canada recently announced the First-Time Home Buyer GST Rebate Program, designed to provide financial relief and encourage more Canadians to take the leap into homeownership.

Understanding the First-Time Home Buyer GST Rebate Program

The program offers a rebate on the Goods and Services Tax (GST) for eligible first-time home buyers, making it easier for them to afford their dream homes. It will apply to the same types of housing and apply similar eligibility criteria and conditions as the existing GST/HST New Housing Rebate, with certain modifications to ensure that the rebate is targeted at first-time home buyers.

Eligibility Criteria

To qualify for the First-Time Home Buyer GST Rebate Program, applicants must meet specific criteria when purchasing a newly constructed home including:

- that you or your spouse/common-law partner cannot have owned a home in the past.

- the agreement of purchase and sale for the home is entered into with the builder on or after May 27, 2025.

How the GST Rebate Works

The GST rebate is calculated based on the purchase price of the new home. Eligible buyers can receive a rebate of the GST paid on homes up to $1,000,000.

How to Calculate GST

Most new home builders provide a List Price that includes the home, lot and GST. To find the GST, you can use these formulas:

GST Inclusive Amount (List Price) / 1.05 (Value of an applicable GST Rate) = Base Price

then

GST Inclusive Amount – Base Price = GST

For example, to find the 5% GST amount for a home with a List Price of $400,000:

$400,000 / 1.05 = Base Price of $380,952

$400,000 – $380,952 = GST of $19,048

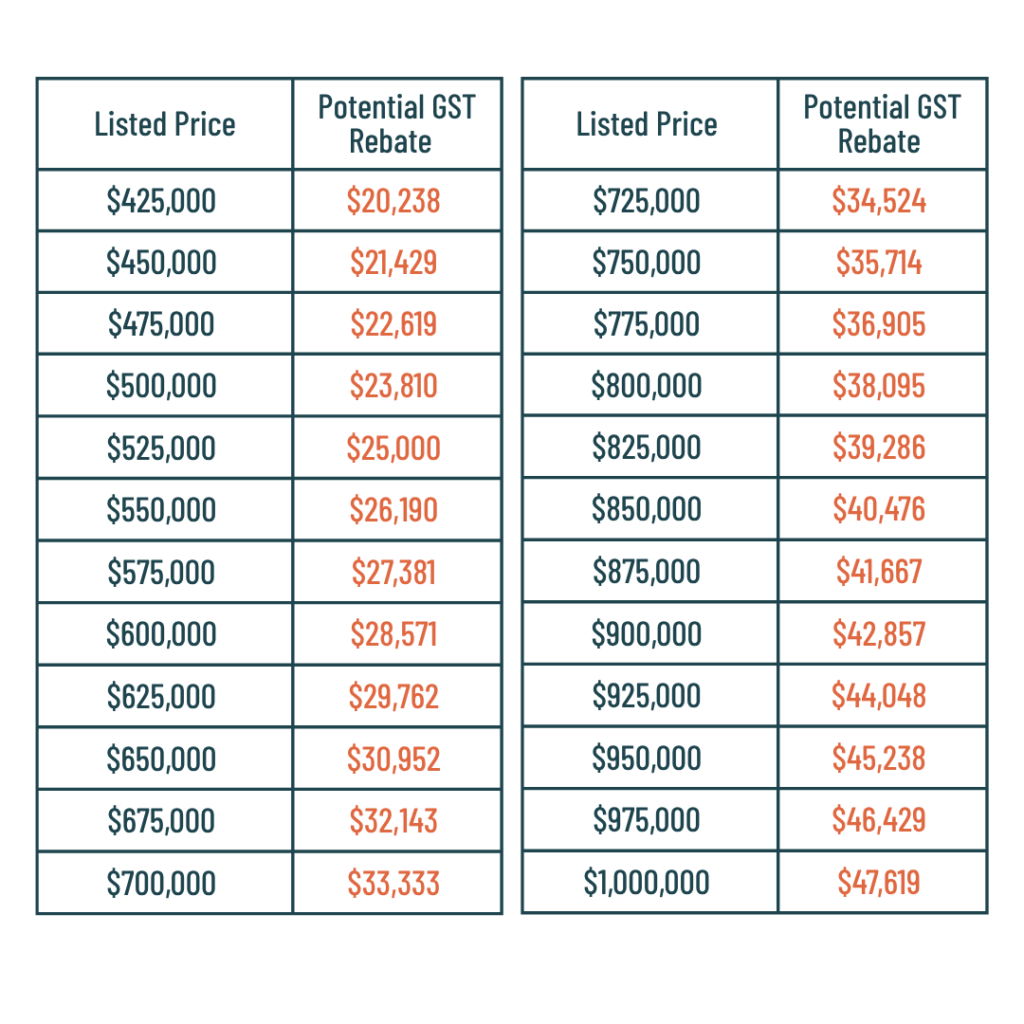

For your convenience, here is a reference chart:

Benefits of the Program

The First-Time Home Buyer GST Rebate Program offers several advantages for prospective homeowners:

- Reduced Financial Burden: The rebate helps lower the overall cost of purchasing a new home, making homeownership more accessible.

- Encouragement to Enter the Housing Market: By offering financial incentives, the program motivates individuals and families to invest in their first home.

- Boosting the Economy: Increased home purchases stimulate the housing market and contribute to economic growth.

Steps to Apply

Applying for the First-Time Home Buyer GST Rebate Program involves several steps:

- Determine eligibility by reviewing the program criteria.

- Contact an Area Sales Manager to begin the process and explore eligible Cantiro homes.

- Stay informed: As of November 2025, the application process is not yet available. The rebate is based on proposed legislation that has been tabled but has not received Royal Assent. [canada.ca]

November 2025 Update: The Government of Canada has proposed legislation to eliminate the GST for first-time home buyers on new homes valued up to $1 million, and reduce it for homes between $1 million and $1.5 million. While the rebate could offer up to $50,000 in savings, applications are still pending final approval and rollout. [canada.ca]

In the meantime, our team is here to support you. Visit any Cantiro show home in Edmonton or Calgary and speak with an Area Sales Manager to learn how to prepare and take full advantage of this exciting opportunity.