Edmonton’s Housing Market: A Positive Outlook for 2023

The housing market in Edmonton has been constantly evolving and the year 2023 looks to be no different. Over the last few of years, changing interest rates, increased costs and supply chain issues have added some uncertainty to the market. With the ever-changing housing market, it can be tough to make a decision. In this blog, we’ll answers all your burning questions about Edmonton’s housing market, giving you confidence to take the next step in your homebuying journey.

Will home prices decline further in 2023?

One of the most significant reasons for the positive outlook of the Edmonton housing market is that we are nearing the bottom of the cycle. This means that the home prices will bottom out and start increasing in the coming months and years. Additionally, the economic conditions in Edmonton and Alberta are improving rapidly, which will lead to an increase in demand for housing.

Is the demand for housing in edmonton increasing?

Another factor contributing to the positive outlook of the Edmonton housing market is our positive net migration. Alberta’s population growth shattered records in the third quarter of 2022 with 58,203 added residents, posting a growth rate of 1.28%. This is the highest rate in the country. With people moving to our city in search of better job opportunities, affordable homes, and a higher quality of life, the demand for housing is expected to increase and drive up home values.

is housing in edmonton affordable?

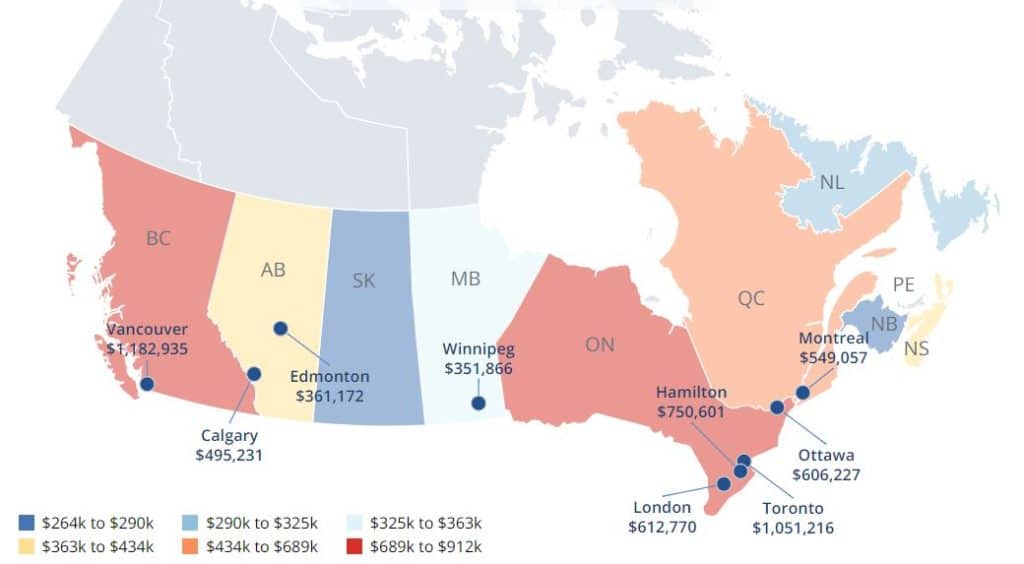

Subsequently, the housing market in Edmonton is still relatively affordable compared to other major cities in Canada. Currently home prices are stable amid generally balanced conditions between buyers and sellers. This means that potential homebuyers have a wide range of options to choose from, including single-family homes, townhouses, and condominiums. Additionally, the affordable prices also make it easier for people to enter the housing market and start building equity.

Average Home Prices in Major Canadian Cities

Will interest rates continue to rise?

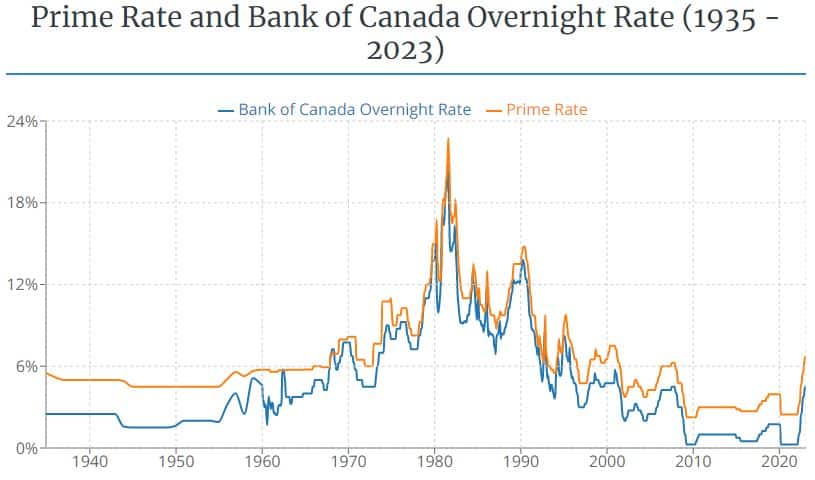

Unquestionably, one of the biggest challenges faced by homebuyers in the current market has been the rising interest rates. Fortunately, the Bank of Canada says it can pause rate hikes as inflation is set to decline significantly in the months to come. The most recent policy interest rate increase of 25 basis points happened on January 25, 2023 and the next scheduled date for announcing the overnight rate target is March 8, 2023.

While the current rates may feel high for those who are new to the market, they are much lower than the 1980s when rates peaked at around 18% and during the 1990s, when rates peaked at around 12%. To offset the impact of the current mortgage rates, you can arrange for short-term financing by taking out a 2 or 3-year fixed rate mortgage. This can help reduce the amount of interest that needs to be paid over the life of the loan and make it easier to manage monthly payments.

when is the Best Time To Buy a house in edmonton & what are the best opportunities?

With the positive outlook and the factors mentioned above, the best opportunities for buyers are right now, with quick possession homes and homes that are already under construction. These homes were priced using lower land and materials costs from 2022 and would be more expensive if you started building them today.

You will get a much better deal today than you will in 6 months due to rising material and land costs. Don’t wait, it is better to have purchased sooner versus paying more later. With the improving economic conditions driving the demand for housing, purchasing now means you’ll start building equity faster.